For most in the investment management industry, meetings are at the heart of our world. We move from one to the next, focused on sharing information in a clear, concise manner. Teams train to ensure their messages sound compelling, the delivery is effective, and resonates.

For most in the asset management industry, meetings are at the heart of our world. We move from one to the next, focused on sharing information in a clear, concise manner. Individuals and teams train to ensure their messages sound compelling and resonate, and that their delivery is effective.

While those aspects are key to ensuring a successful meeting, often presenters concentrate so much on what they are saying, they forget to listen. Whether executing an external meeting with a prospect, an investor, or a consultant, or an internal meeting with colleagues, a balance of both what you say and how well you listen, is essential.

As we listen, our brains are triggered to immediately start to think about what we will say next. Sometimes it is in response to what we are hearing – other times it is merely a reply filled with what we want to say. Or we just get distracted and forget to listen. Have you ever been in a meeting and found yourself jotting down a to-do list?

- Work out

- Make dentist appointment

- Pay bills

- Edit the quarterly update

It happens. Raising awareness of the importance of fully listening and not being distracted augments the experience during a meeting, helps to build rapport, and ultimately to achieve a more mutually positive outcome.

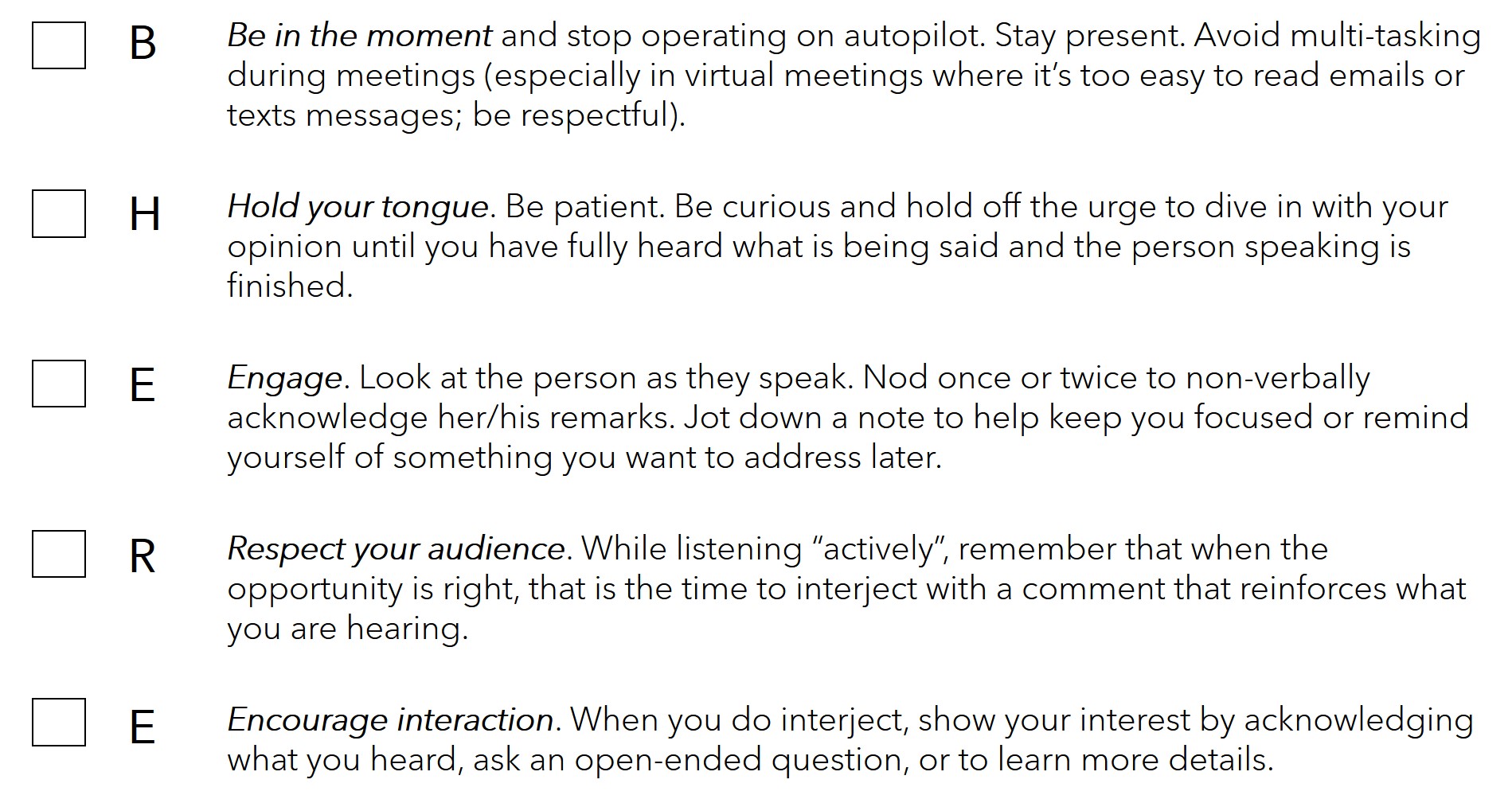

During your next meeting, strive for balance between what you say and not losing the art of listening – here’s a to-do list:

B(e) H E R E